The Color of the Capital Gap: An Update and Discussion

November 28, 2023

“We believe it is possible for people of color to build collective wealth whose benefits extend beyond the individual people, but to the entire community.”

Those words from TBF President and CEO Lee Pelton set the tone for the . November 28th forum, an update to the 2021 report The Color of the Capital Gap: Increasing Capital Access for Entrepreneurs of Color in Massachusetts. An audience of over 100 in-person and online guests listened actively as researchers and panelists explored how the challenges facing small businesses of color in acquiring capital had evolved in the two years since the report.

Orlando Watkins, TBF Vice President and Chief Program Officer, followed Pelton’s remarks. “Imagine the impact we’d have on the GDP and wealth creation if we organize ourselves around closing that capital gap. Today we’re here to go deeper into this unmet demand for capital for entrepreneurs of color,” Watkins said.

Determining how that unmet demand had evolved was the job for Matt Brewster, principal of P2 Advisors, LLC, who shared recent data on the capital gap in Massachusetts.

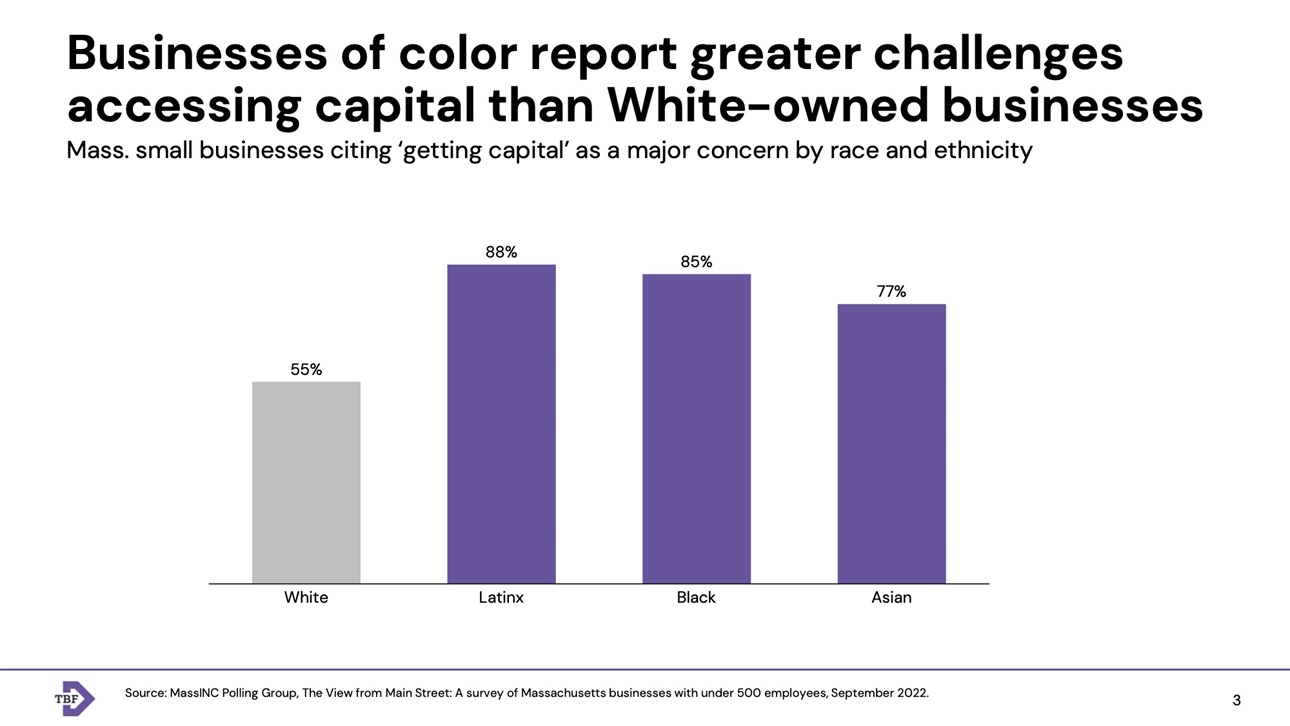

Brewster, who co-authored the 2021 report, showed data continuing two themes from the 2021 report: the heightened concern of businesses of color being able to get capital, and their lower likelihood of actually receiving it. 88% of Black-owned businesses, 85% of Latinx-owned businesses, and 77% of Asian-owned businesses call capital access a top concern, versus only 55% of white-owned businesses.

But of those who applied for capital, Brewster noted, business owners of color were twice as likely to say they had been denied financing, or received less than the full amount they requested.

Other data reinforced the theme – majority people of color areas received fewer small business loan dollars per business; POC-owned ventures received far less VC funding that white-owned ventures, and so on. Overall, Brewster found a 5% increase in the capital gap between white businesses and businesses of color since 2019.

For the panel discussion that followed, the data was sobering, but not surprising. To dig into the causes of this gap and the possible solutions, Tracye Whitfield, Executive Director of the Coalition for an Equitable Economyand moderator of the panel, brought to the stage four experts in the field: Amine Benali, Managing Director of the Local Enterprise Assistance Fund; Betty Francisco, CEO of the Boston Impact Initiative; Glynn Lloyd, Executive Director of Mill Cities Community Investments and the Foundation for Business Equity, and Reggie Williams, Director of Small Business for the Dorchester Bay Economic Development Corporation.

Whitfield opened the discussion with a compelling question: what are the possible reasons for the gap? While there is no way to pinpoint the reasons with certainty, panelists highlighted a number of factors. Lloyd identified the centuries of institutional racism in this country as a clear root cause. Francisco noted that entrepreneurs of color tend to be perceived as riskier investments, whether through discrimination or a lack of understanding by asset managers of the connections between community businesses and local needs in non-White communities.

Williams turned the concept of risk on its head, asking “what is the risk of not investing in these businesses?” He believes the result is a large amount of untapped potential, and that mitigating this risk requires building trust between businesses and the industry. Williams believes that an important aspect of this is “making sure that we have what we need to be successful as lenders to educate and work deeply with the communities we serve, and that work takes time.”

But panelists also noted a number of policies and programs that have had success in recent years. Francisco noted that the Coalition for an Equitable Economy could trace its roots to the COVID pandemic, when community organizations, banking institutions, and Community Development Financial Institutions (CDFIs) came together for an emergency COVID response and to make sure businesses could get access to the Paycheck Protection Program (PPP). “When you build strong coalitions [and] collaborations, it starts from trust-based relationships, and that’s eventually how we move money,” Francisco said. “We all do trust-based diligence and underwriting, so when you come together and collaborate at that massive capacity to move a lot of money, you start to see where the issues are.”

Looking ahead, panelists said that sort of collaboration remains critical. “Were it not for the organization and the efforts of CDFIs and the small business organizations,” Benali said, “[Businesses] would not have been reached and they would not have known” about the pandemic-related funding. “These were organizations that knew each other before, maybe collaborated to some degree, maybe competed to some degree before the pandemic, but that event brought them together… and the outcome was very, very positive.”

“Breaking those barriers that existed before 2020 sadly took a catastrophic event of the pandemic,” Benali said, “and maybe moving forward, we don’t need those catastrophic events. Maybe we just nurture this ecosystem, and nurturing that system means cultivating trust.”