Investing in Change

The Business Equity Fund

TBF News Summer 2021

Last year, in response to the racial inequities laid bare by COVID-19 and the Black Lives Matter movement, statistics pointing to the enormous wealth gap between families of color and white families were suddenly the focus of media outlets across the country. But it was a report from the U.S. Department of Commerce that caught the eye of some large financial institutions. It revealed that loan denial rates for businesses owned by people of color were two times higher than for those owned by white people— and the average interest rate for the loans that were given was 22 percent higher.

As a result, large banks began pledging to do more to support businesses owned by people of color. But a Boston Foundation initiative called the Business Equity Fund (BEF) already had been doing just that since 2018. Greg Shell, who chairs the BEF’s Investment Committee, is skeptical about the sudden awakening.

“It’s really an exercise in dishonesty to wonder how you have the economic outcomes that we have in this country,” says Shell. “Those outcomes are engineered. The big question is whether it makes sense to perpetuate the approaches that have gotten us here. The answer is clearly no.” In fact, according to a 2019 McKinsey & Company report, reducing the racial wealth gap could increase the U.S. GDP by as much as six percent by 2028, benefiting everyone in America.

“When the lack of equity experienced by businesses of color was the focus of so much media attention, a number of people I know were desperately searching for ways to help, to make a difference,” says committee member Lizette Pérez-Deisboeck. “I was proud that through the BEF, we were already doing something—something important.”

The goal of the BEF is to help businesses of color employ more people, build more wealth and thrive. The Fund is designed to provide both flexible financing and patient capital to businesses that already are doing well and positioned for growth. To date, seven busi-nesses have received a total of $2.3 million in low-cost loans. All of them survived COVID.

“When the pandemic hit, the BEF had to rewrite the playbook,” says Jared H. Ward, another committee member who has worked for 40 years in the commercial banking field. In the early days of the COVID crisis, the Fund stepped up to offer deferments on loan payments for the companies in which it has invested. “The Investment Committee also decided to provide additional capital to several businesses to help them survive,” adds Ward.

“We are very fortunate that the Business Equity Fund operates within an ecosystem of support,” says Boston Foundation Vice President for Programs Orlando Watkins, who spearheads the BEF for the Foundation. “That includes the Business Equity Initiative, which provides consulting and mentoring to Black and Latinx businesses, and the Greater Boston Chamber of Commerce’s Pacesetters Initiative, which encourages its members to spend more of their procurement dollars on businesses of color. It’s the strength and breadth of that ecosystem that makes this work so effective and rewarding.”

In addition to an early and major grant from Eastern Bank and funding from the Boston Foundation, the BEF has attracted investments of close to $6 million for a total of $8.8 million.

Andrew Balson, who has a Donor Advised Fund at the Boston Foundation, was an early investor and recently scaled his commitment. “I believe in capitalism, but it doesn’t work for everyone,” says Balson. “To me, the market fails when it comes to access to capital for people who come from neighborhoods where there isn’t a lot of family wealth.” He credits the fact that the investments are accompanied by seasoned professionals who offer technical assistance to the businesses. “The combination is powerful and the early returns are good,” he adds, “even taking COVID into account.”

Greg Shell agrees. “In many cases, these businesses are on the cusp of achieving improvement and growth and what we try to do is give them a combination of capital, technical assistance, training and commercial opportunity. And the investments don’t just benefit the companies. These are businesses that tend to hire people in their neighborhoods. So, you get wealth building for the business owners, customers who are well served and hiring activity in neighborhoods. We’re learning more about how to do this in the best way—to help these businesses be the best version of themselves.”

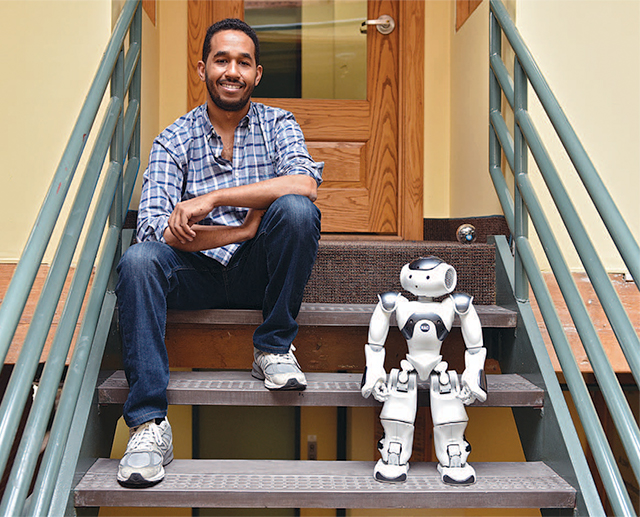

One of the recent businesses to receive support is Eduporium, an early-stage, high-growth reseller of STEM products and tools to the education market. “We had two strategic advisors who helped our team create a mid-term strategic plan,” says CEO and Owner Rick Fredkin. “Then the BEF’s Investment Committee gave us the opportunity to build our case.” Eduporium prioritizes recruiting Black and Latinx workers, meeting one of BEF’s goals, which is to encourage more businesses of color in the booming technology space. “Our ultimate goal,” says Fredkin, “is to be a major name in the education technology field.”