The Power of Non-Cash Gifts

A Smart Way to Maximize Your Clients’ Philanthropy

THE BOSTON FOUNDATION DIFFERENCE

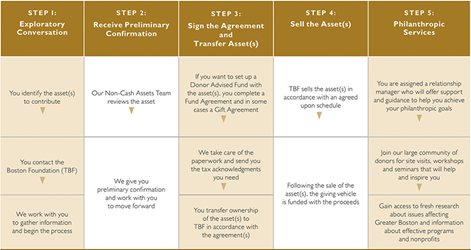

When non-cash (complex) assets are properly transferred to a fund at the Boston Foundation, they can be sold without incurring capital gains taxes and the proceeds can be given to charity. As a professional advisor, you know that much of your clients’ wealth is in holdings such as appreciated securities, privately held stock or limited partnerships.

A non-cash transaction with the Boston Foundation is a smart approach that benefits you, your clients and the causes they care about and assures that you and your clients will be supported throughout the entire giving process.

The Boston Foundation offers direct access to our highly experienced Non-Cash Assets Team. No bureaucracy. No waiting for approvals from management. Instead, from your initial inquiry, you will work with our most senior staff and receive thoughtful, meticulous, personalized service. We stand ready to provide philanthropic support to you and your clients after the transaction to ensure that your clients’ goals are achieved.

WHAT TYPES OF ASSETS DO WE ACCEPT?

- Publicly traded securities

- Restricted stock

- Privately held interests (C-Corp and S-Corp stock, limited partnerships or LLCs)

- Private equity interests

- Real estate

- IRAs, retirement accounts

- Miscellaneous or unique assets (patents, mineral rights, royalties)

- Whole life insurance policies, annuities

HOW DO YOUR CLIENTS BENEFIT?

- Tax deductions: Gifts of appreciated securities and other long term capital gain property to a Boston Foundation fund are generally eligible for a full fair market-value deduction for income and gift tax purposes.

- Greater Impact: Because the non-cash assets are sold by the Boston Foundation, they generally do not generate capital gains taxes. As a result, your clients have more resources to direct to charity.

- Access to philanthropic expertise: Whether your client is just beginning the philanthropic journey or possesses a high level of clarity and sophistication, our relationship managers can sit down with you and them to discuss their ideas, values and the issues that are most important to them. In addition to being welcomed into our vibrant donor community, they will have access to workshops and events designed to equip donors with the information and tools they need to maximize the impact of their philanthropy. Boston Foundation staff members have deep knowledge of local nonprofits working to solve some of our region’s biggest problems. They also have strong relationships with other community foundations across the country, and with international philanthropy. This provides your clients philanthropic support whether they decide to make grants locally, nationally, or internationally.

- Online support: We provide robust fund services and expert grant-making assistance.

HOW DO YOU BENEFIT?

- Quick, easy access: You will have instant access to our senior-level staff with decades of experience handling gifts of complex assets.

- Continued support: The Foundation handles compliance with IRS rules with due diligence and arranges for the sale of non-cash assets, freeing you and your clients from the administrative and legal burdens. We realize that these transactions can take place at any time, day or night, and we are here to provide support at any time and at any level of difficulty. In the case of all assets that are not cash or marketable securities, your client will need to provide a Form 8283 (non-cash charitable contributions report) for execution by the Foundation. Generally, your client is responsible for a gift appraisal.

HOW DO WE PARTNER WITH ADVISORS?

As one of the nation’s oldest and largest community foundations, with more than $1 billion in philanthropic assets under management, the Boston Foundation has a long history of partnering with financial, legal, wealth and other advisors to achieve their clients’ charitable goals. We provide additional support to your work and are able to provide philanthropic tools and guidance. We understand the relationships that you have built with your clients and work alongside you to maintain a high level of customized service.

Note: The Boston Foundation and its staff do not provide legal, tax, or financial advice. Donors should seek their own legal, tax and financial advice in connection with gift and planning matters.

How can you get started?

Email Kate Guedj, Senior Vice President and Chief Philanthropy Officer.